Announcement on Collaboration for Issuance of a Digital Bond Using a Settlement Scheme New to Japan and a Proof of Concept for Japan’s First Securities Settlement Using Digital Currency

Nomura Research Institute, Ltd. (Headquarters: Tokyo, Japan; President & CEO Kaga Yanagisawa, hereinafter referred to as “NRI”), Nomura Securities Co., Ltd. (Headquarters: Tokyo, Japan; Representative Director and President Kentaro Okuda; hereinafter referred to as “Nomura Securities”), BOOSTRY Co., Ltd. (Headquarters: Tokyo, Japan; CEO Toshinori Sasaki; hereinafter referred to as “BOOSTRY”), and DeCurret DCP Inc. (Headquarters: Tokyo, Japan; Representative Director, Chairman and President, CEO Satoshi Murabayashi; hereinafter referred to as “DeCurret DCP”) , Sumitomo Mitsui Banking Corporation (Headquarters: Tokyo, Japan; President and Chief Executive Officer Akihiro Fukutome; hereinafter referred to as “SMBC”) have had discussions regarding the below initiatives, which introduced a new settlement scheme that would expand the market for digital securities and implemented a proof of concept to demonstrate the scheme’s feasibility (hereinafter referred to as the “project”) .

1.An issuance of a digital bond (hereinafter referred to as the “digital bond”) using a settlement scheme new to Japan

- Settled by delivery versus payment (DVP)*1, a first for a digital bond in Japan

- Settled on the trade date + 1 business day, the shortest settlement period for the new issue of a domestic corporate bond

2.Proof of concept for settlement of a security using digital currency, the first such transaction in Japan (hereinafter referred to as the “PoC”)

- This demonstration was conducted separately from the digital bond issuance

*DeCurret DCP only participated in the PoC

■Background of this project

Ever since NRI issued the first digital bond (a private placement bond) in Japan in 2020, the Japanese market for digital securities has accelerated, both in terms of diversification of products and the number of financial institutions handling them. The total value of public issuances has grown to more than 150 billion yen. On the other hand, settlement risk has been pointed out as one of the obstacles to trading in the domestic market for digital securities, particularly for growing the pool of investors in wholesale digital bonds. This project seeks to demonstrate the utility of a new settlement scheme that combines BOOSTRY’s new system and SMBC’s banking service, applied to a digital bond newly issued by NRI to introduce Delivery Versus Payment as a standard settlement method for trading security tokens, reducing settlement risk with the future aim of expanding the trading of digital bonds.

Separately from the above issuance of digital bonds, it was decided to conduct a test mint of DCJPY, a type of digital currency developed by DeCurret DCP that represents tokenized deposits *2, using the testing environment for DCJPY and applying them to the settlement process anticipated for digital bonds to show that a digital currency can be used in the place of fiat currency (yen) for trading in digital bonds (the PoC). Digital currencies, which are a focus of attention worldwide as a new means of payment, hold promise as an effective means to make securities settlement processes more efficient and reliable; this PoC will be a starting point for transforming securities settlement processes as well as a first step toward greater convenience for users.

■Key points of the project

1. An issuance of digital bonds utilizing a new settlement scheme

[Outcomes achieved from this digital bond issuance]

i.The first digital bond in Japan to offer DVP settlement

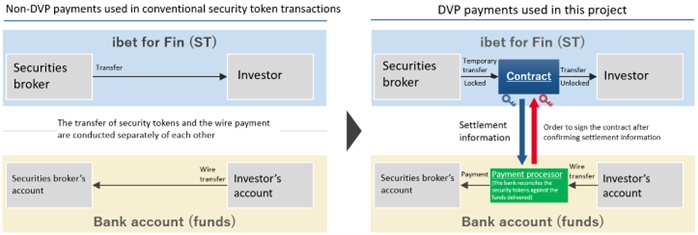

With respect to wholesale bonds in Japan, the Japan Securities Depository Center (JASDEC), whose book-entry transfer system has provided an electronic record and rendered physical securities unnecessary, has widely offered DVP settlements as part of its function of reducing settlement risk. But because digital bonds are not handled by JASDEC, DVP has not been available for digital bonds.

For the digital bonds in this project, DVP was made possible using the new smart contract *3 functions on ibet for Fin, a blockchain whose development was led by BOOSTRY and which is operated and maintained by BOOSTRY as the secretariat for the ibet for Fin consortium, together with the banking services of SMBC. Specifically, DVP was achieved by reconciling information on the trading of digital bonds against the bank remittance information of the parties to the trade, using ordinary bank accounts that are accessed day-to-day. This demonstrated that DVP can be offered as a standard settlement method for trading in security tokens.

ii.Settled on the trade date + 1 business day, the shortest settlement period for the new issue of a domestic corporate bond

To settle trades in book-entry transfer bonds (publicly traded) at the time of issue, settlement is set for the fourth business day from the trade date or later, in accordance with JASDEC procedures. On the other hand, JASDEC procedures do not apply to digital bonds, since they are not handled by JASDEC, so the settlement period can be reduced by making post-trade processing more efficient. In this project, the parties to the settlement of this security considered ways to streamline the process and achieved the fastest settlement ever for publicly traded bonds in Japan: the trade date + 1 business day. Reducing the settlement period reduces settlement risk following the closing of a trade and offers the added advantage of making the procured funding available to the issuer sooner. In future, it will be possible to complete transaction processing even more quickly by digitalizing all work processes by the relevant parties.

[The new settlement scheme adopted for the digital bond]

[Overview of this digital bond issuance]

| Name of bond | Nomura Research Institute, Ltd. 15th Unsecured Bond(with inter-bond pari passu clause and transfer restrictions) |

| Total amount of issue | ¥3 billion |

| Maturity | 5years |

| Coupon | 1.483% per annum |

| Issue price | ¥100 per ¥100 of face value |

| Closing date | March 14, 2025 |

| Maturity date | March 14, 2030 |

| Rating | AA− Rating and Investment Information, Inc. (R&I) |

| Underwriter and digital structuring agent *4 | Nomura Securities |

| Fiscal agent / bond registry administrator / payment agent | SMBC |

| Digital securities platform developer | BOOSTRY |

2.PoC for the use of digital currencies in settling securities trades

Digital currency is a general term for assets with features like money that are recorded, stored, and transferred using distributed ledger technology; digital currencies are a focus of attention worldwide for their potential to automate settlements using the functions of distributed ledgers, reducing effort, labor costs, and human error, and expanding the future possibilities for processing securities trades.

[The scheme of DCJPY, the digital currency adopted for this PoC]

[Overview of this PoC]

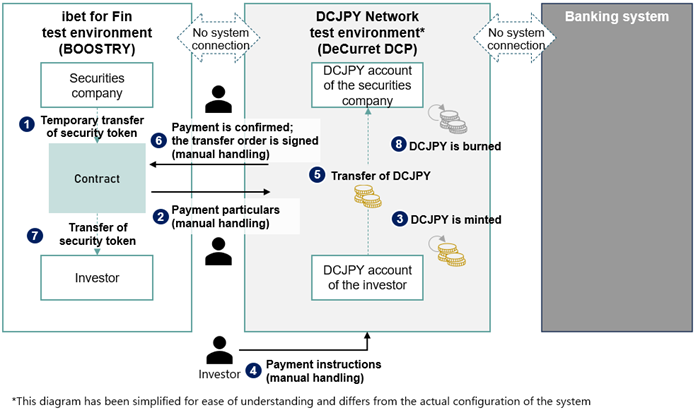

Existing processes for settlement of digital securities are premised on the use of legal tender, but this PoC has confirmed the successful simulation of this process in a test environment with digital currency used in the place of a fiat currency. To implement this test, the parties to the securities settlement gathered in an actual physical space to consider the feasibility of future securities settlements in digital currencies.

[Future possibilities and level of anticipation for settlements in digital currencies]

■Expanding the base of participants in digital securities trading

- The system set up by BOOSTRY provided the testing environment to simulate DVP for digital bonds, allowing the group to confirm that the system could be used not only for conventional settlements in fiat currencies using bank accounts, but also more versatile use such as settlement in DCJPY offered by DeCurret DCP. It was demonstrated that this could be a standard scheme for DVP settlement of digital bonds that could be applied to other use cases.

-Based on the workflow for DVP settlements confirmed in this PoC, the systems of BOOSTRY and DeCurret DCP might be mutually linked in the future to achieve an efficient DVP settlement scheme for digital bonds.

■In the future, it may be possible to make the following kinds of securities settlements more efficient and reliable by employing smart contracts and other features of digital currencies.

- Straight through processing (STP)*5 of securities transactions using digital currency settlements

- Same-day settlements (trade date + 0 business days) and real-time gross settlements

- Automated payment of bond coupon, redemption money, etc.

■Extension to other types of currencies and accounts; interconnectivity with other digital currencies could increase the utility of this system for parties to securities settlements

[Key issues to be resolved before practical use]

■Issuance and use of digital currencies

- The complexity of system requirements needed to handle bank deposits as tokens on a distributed ledger system (such as consideration of both the discrete and general features of digital currency platforms meeting the legal policies of individual financial institutions, which are based on the supervisory guidelines of the Financial Services Agency)

- Establishing the economic justification for the investment needed to connect to a core banking system

- Preparations by issuing banks and establishment of regulations, etc. in view of the characteristics and legal status of digital currencies

- Establishing readiness on the user side for the use of digital currencies

- Diversification of use cases for digital currencies

■Securities settlements using digital currencies

- Standard handling of digital securities within existing systems for securities trading

- Establishing seamless connectivity between the systems involved in securities settlements

- Establishing methods for DVP settlement of digital securities or digital currencies traded on separate distributed ledgers

- Standardization of securities settlement processes using digital currencies and adoption across the industry

[Future direction]

Focusing on the issues relating to securities settlements using digital currencies, the participants intend to formulate standard work processes and flows based on the content of deliberations in this PoC and to pursue further discussion on standardization relating to connectivity between the systems involved in securities settlements.

Company comments

NRI

“This project to procure funding using digital bonds is one of our novel initiatives and we believe it to be an important step toward a larger market for digital securities.

We will continue our efforts to diversify funding channels to help organizations raise capital more reliably. As an IT-driven provider of social and financial infrastructure, we will fulfill our corporate responsibility by contributing to the healthy development of society and capital markets.”

Nomura Securities

“In this project, the settlement risks for digital bonds were successfully reduced, which represents a major breakthrough. The project was also an opportunity to deepen our understanding of digital currencies as a new settlement tool that will enhance user convenience.”

BOOSTRY

“The need for secure DVP has been a major issue with security tokens, and the project established that this can be achieved through a practical mechanism that does not rely on specialized solutions such as stablecoins. We believe that this will help drive significant advancements for the industry.”

DeCurret DCP

“Working with key players in the relevant industries, this project succeeded in identifying a standard operational flow that enables DVP for digital bonds. We feel this is a giant step toward further development of the industry.”

Notes

*1 Delivery Versus Payment (DVP): A settlement mechanism that links a securities transfer and funds transfer such that each is the condition of the other, ensuring that delivery occurs if, and only if, payment occurs

*2 Tokenized deposits: A type of digital asset in which conventional deposits are digitalized using blockchain or distributed ledger technology. Various initiatives are underway in Japan and elsewhere; markets overseas are considering the practical use of tokenized deposits (known as deposit tokens when referring to the native token on blockchain).

*3 Smart contracts: Digital contracts that are automatically executed when certain predetermined terms and conditions are met.

*4 Digital structuring agent: An agent that structures a digital bond and assists the issuer through activities such as selling the bond to investors and providing advice on the required documentation.

*5 Straight through processing (STP): The automated processing of a securities sale, from placement of an order to closing and settlement.

This press release was prepared for the purpose of informing the public about its subject matter. It is not intended to solicit any investment in any securities instrument issued by NRI