Testing of Business Process Automation for Insurance Policies Using Blockchain

Testing of Business Process Automation for Insurance Policies Using Blockchain

Automation of Insurance Claims Payment Using Smart Contracts

Tokio Marine & Nichido Fire Insurance Co., Ltd. (President and Representative Director: Shinichi Hirose, hereinafter “Tokio Marine & Nichido”) and DeCurret Inc. (President and Representative Director: Kazuhiro Tokita, hereinafter “DeCurret”) conducted testing the use of the blockchain technology to automate insurance contract processes since March 2020, including collection of premiums and payment of claims.

1.Background

Taking out an insurance policy involves paperwork ranging from payment of premiums and receipt of claims. Use of business and financial transaction processes that take advantage of characteristics of digital currency and blockchain technologies can make such paperwork more efficient and faster, helping to improve customers convenience. It is also expected to contribute greatly to making insurers’ business processes more efficient and faster.

Tokio Marine & Nichido and DeCurret plan to test a transaction system that uses digital-currency and blockchain technologies. The test is conducted as part of a capital tie-up between them in which Tokio Marine & Nichido acquired a stake in DeCurret in January 2018.

2.Overview

This project tested the technology to automate business processes, including collection of insurance premiums and payment of claims, using a platform for issuing and managing digital currency on the blockchain, being developed by DeCurret. Specifically, information on insurance policies was preregistered on the blockchain, and information on an accident was read onto the blockchain after it occurs. The system then automatically judged whether the accident satisfied specified requirements for payout, and, if it so judges, made the payout immediately in a digital currency. The project aimed to verify the effectiveness of this system.

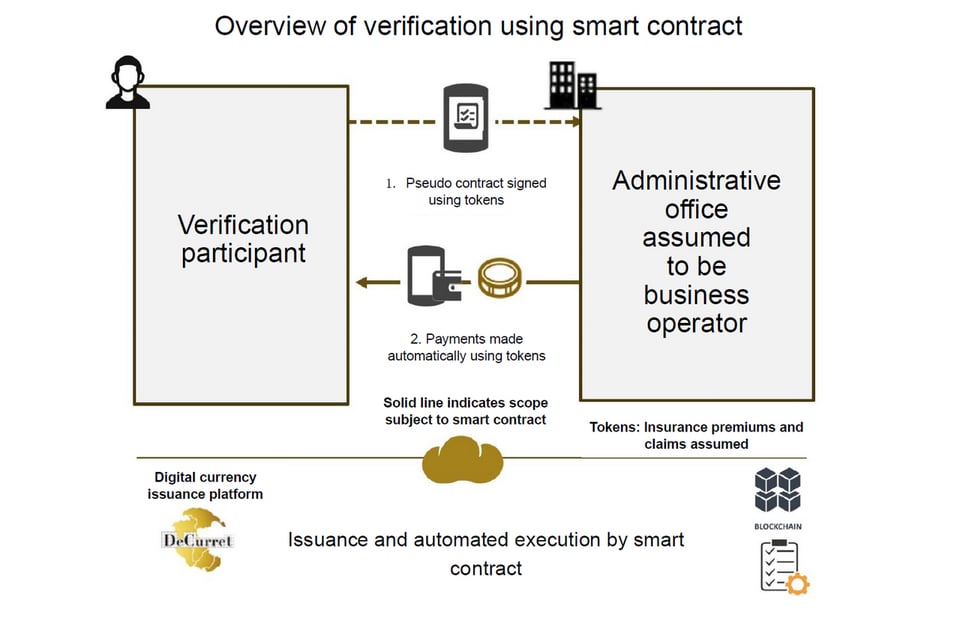

The project also experimented the effectiveness of a system for automated payment of insurance claims using smart contracts*1 in which tokens were issued*2 to Tokio Marine & Nichido and Tib*3, a voluntary group formed by its young employees, and such tokens were regarded as insurance premiums or claims.

Tokio Marine & Nichido and DeCurre aim to create an improved system for insurance in the future.

*1: A system which automates a variety of processes, including transfer of funds and payment.

*2: Tokens are issued as a pseudo digital currency. They are used only between the relevant parties, without being exchanged with the yen.

*3: A group of young Tokio Marine & Nichido group employees who voluntarily came together with a common goal of inspiring excitement of trying new

DeCurret’s platform

The platform developed by DeCurret is equipped with functions that allow user companies to issue unique digital currencies, with capacity to install processes using smart contracts. It improves the efficiency of transaction processes and is capable of handling small-amount transactions in real time.

This platform will support a wide range of services that utilize features of blockchain such as dynamic pricing and real time payments.

DeCurret aims to commercialize the platform and intends to continue increasing the range of services that improve the convenience of digital currencies such as transfer of value to existing settlement services, and exchange functions and services.

【DeCurret】Testing-of-Business-Process-Automation-for-Insurance-Policies-Using-Blockchain.pdf