SBI Shinsei Bank, Partior, and DeCurret DCP Agree to Launch Full-Scale Study on Foreign Currency Transactions Using Tokenized Deposits

Tokyo, September 16, 2025 — SBI Shinsei Bank, Limited. (Head Office: Chuo-ku, Tokyo; Representative Director, President: Katsuya Kawashima, “SBI Shinsei Bank”), Partior Pte. Ltd. (Head Office: Singapore; CEO: Humphrey Valenbreder, “Partior”), and DeCurret DCP Inc. (Head Office: Chiyoda-ku, Tokyo; Representative Director, Chairman and President, CEO: Satoshi Murabayashi, “DeCurret DCP”) today announced that the three companies have signed a Memorandum of Understanding to build a strategic partnership framework.

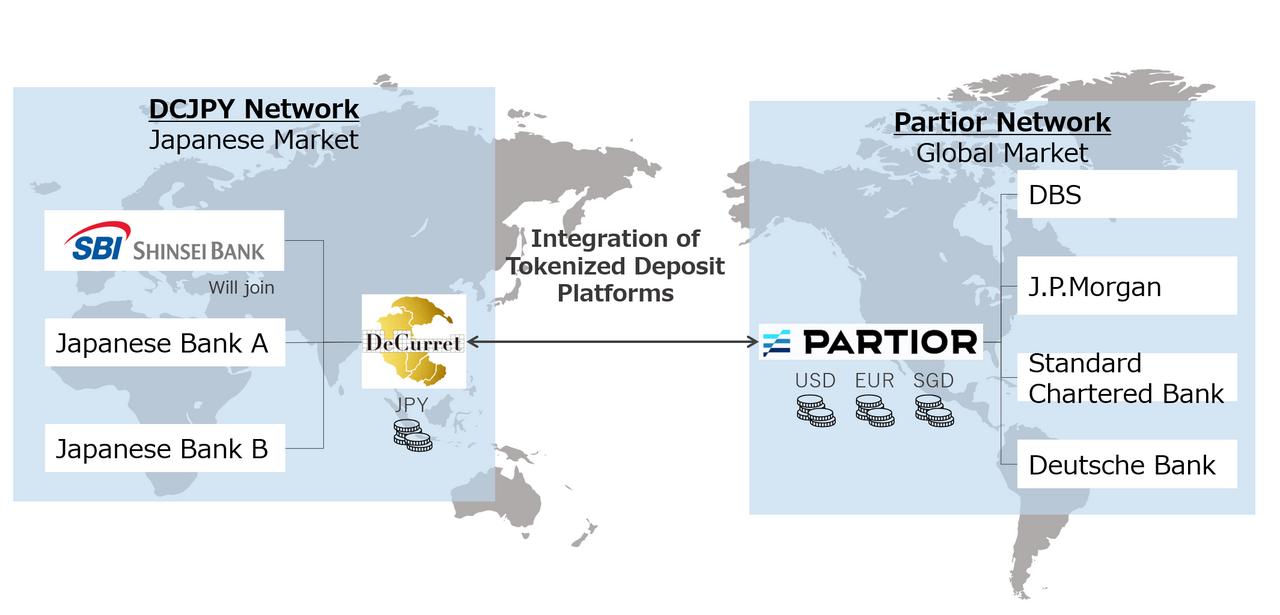

SBI Shinsei Bank and DeCurret DCP, which provides the DCJPY *1tokenized deposit*2 platform in Japan, will begin full-scale consideration of implementing multi-currency clearing and settlement solutions using tokenized deposits and Distributed Ledger Technology (DLT), by leveraging Partior’s multi-currency settlement platform for digital money, which is already in use by major global banks including DBS, J.P. Morgan, Standard Chartered, and Deutsche Bank.

【Image of Collaboration with Partior’s Interbank Currency Settlement Platform】

1. Overview of the Initiative on Cross-Border Remittances Using Tokenized Deposits

SBI Shinsei Bank has a large corporate client base. To deliver new value to both corporate and retail customers, the bank has initiated consideration of introducing DCJPY (a JPY-denominated tokenized deposit), while also exploring the handling of tokenized deposits in foreign currencies within this framework.

Partior already provides its digital money settlement platform to leading banks such as DBS, J.P. Morgan, Standard Chartered, and Deutsche Bank, with proven capabilities across multiple currencies, including USD, EUR, and SGD.

DeCurret DCP provides a tokenized deposit issuance platform for Japanese banks, enabling JPY-denominated deposit tokens.

Through this strategic partnership:

- SBI Shinsei Bank will begin concrete studies on issuing tokenized deposits not only in JPY but also in multiple currencies to meet the diverse needs of its customers.

- Partior will enhance its service offerings by adding the JPY to its portfolio of supported currencies, thereby improving both functionality and user convenience.

- DeCurret DCP will connect its JPY-denominated tokenized deposits to Partior’s international network, aiming to enable real-time cross-border settlement between JPY and other currencies, even within closed domestic chain environments.

The three companies will leverage their respective strengths to create a settlement environment that is transparent, rapid, and available 24/7.

2. Next Steps

The three companies will soon begin discussions to define detailed roles and responsibilities with the aim of concluding a formal business collaboration agreement at an early stage.

*1 DCJPY: A JPY-denominated tokenized deposit provided by DeCurret DCP.

*2 Tokenized Deposits: Conventional bank deposits enhanced through the use of blockchain and other technologies, often referred to as “deposit tokens,” with adoption expanding globally.