Shinoken Group and JAPAN POST BANK Start Collaborative Digital Currency (JAPAN POST BANK's Tokenized Deposits) PoC!

DeCurret DCP Inc. (Head Office: Chiyoda-ku, Tokyo; Representative Director, Chairman and President, CEO : Satoshi Murabayashi; hereinafter “the Company”) announces that it has signed a basic agreement for collaboration with Shinoken Group Co., Ltd. (Tokyo HQ : Minato-ku, Tokyo; President and Representative Director: Takashi Tamaki; hereinafter referred to as “Shinoken Group”) and JAPAN POST BANK Co., Ltd. (Headquarters: Chiyoda-ku, Tokyo; President & CEO, Representative Executive Officer, Member of the Board of Directors : Takayuki Kasama; hereinafter referred to as “JAPAN POST BANK”) have entered into a basic agreement for collaboration to utilize JAPAN POST BANK's tokenized deposits (hereinafter referred to as “Tokenized Deposits”).

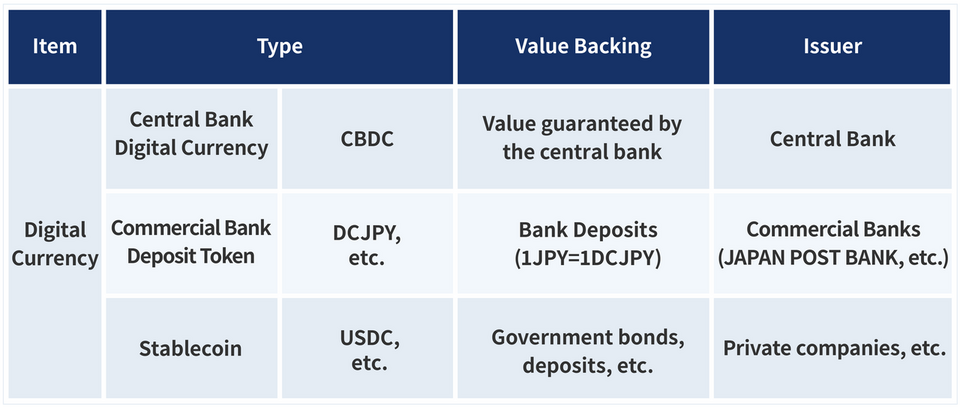

1.Tokenized deposits

Tokenized deposits are bank deposits converted into tokens. They offer the same security and reliability as traditional bank deposits while leveraging technologies like blockchain to provide convenient digital access. By linking transaction records and contract terms, they enable diverse services such as controlling and automating fund flows. While proof-of-concept (PoC) trials for various industries are currently underway, the Shinoken Group is the first* to conduct a PoC utilizing tokenized deposits within the real estate industry.

(Types of Digital Currency)

(Mechanism of Tokenized Deposits)

2.Proof-of-Concept and Schedule

This proof-of-concept (PoC) will verify the automation and efficiency of payments utilizing tokenized deposits, using the monthly rent payments in Shinoken Group's rental management as a use case. We aim to complete this by the end of December 2025. Based on the results, we will proceed with preparations for full-scale implementation starting in 2026.

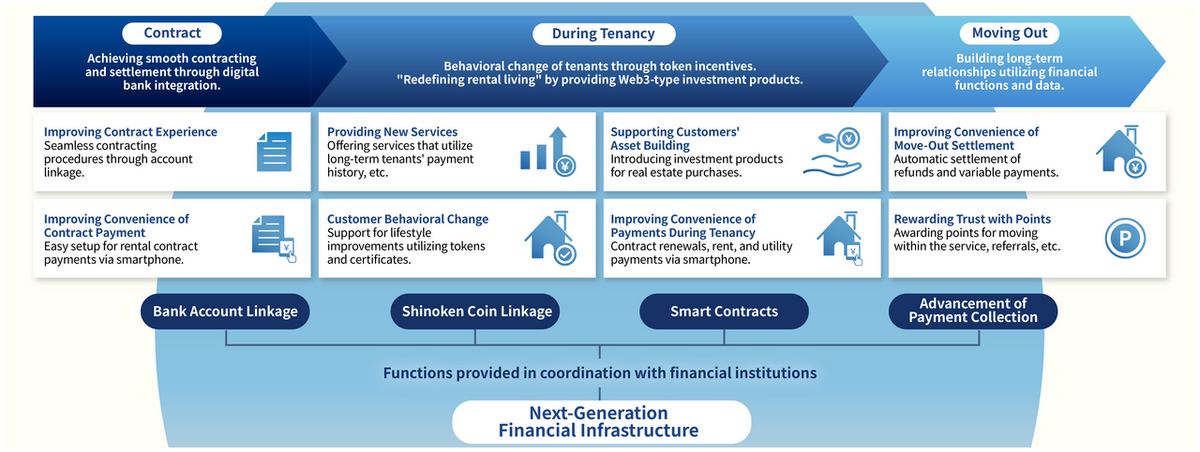

3.Future Service Development

Using this tokenized deposit, which enables instant settlement, allows for greater flexibility and convenience in daily life. For example, payments that previously had fixed due dates—such as rent, gas, and electricity bills—can now be freely set within a certain range according to the customer's convenience.

Furthermore, the Shinoken Group is considering rewarding “Shinoken Coins” (the Group's proprietary points) based on lifestyle history, such as tenancy duration, payment history, and tenant referrals. The goal is to enable seamless use of accumulated Shinoken Coins across services provided by the Shinoken Group, such as searching for your next residence.

Conceptual Image of Business Initiatives Utilizing Shinoken Group's Tokenized Deposits

4.Our Future Outlook

Through collaboration with the Shinoken Group and JAPAN POST BANK, we will enter into the real estate industry's settlement services for the first time. By working together to solve industry challenges and create new value, we will contribute to the overall development of the real estate sector through tokenized deposits. Moving forward, we will continue to work with various companies to create new economic ecosystems using tokenized deposits.

■Company Overview

―Shinoken Group

Shinoken Group, with the vision of being “A life support company for every generation across the world,” operates as a socially responsible enterprise. They provide services that support the lives and entire lifespans of our customers, including children, youth, seniors, individuals with disabilities, and their families. These services encompass safe and secure housing, essential living infrastructure such as energy supply, nursing care services, and after-school day services.

Company Name: Shinoken Group Co., Ltd.

Representative: Takashi Tamaki, President and Representative Director

Business Description: Management of subsidiaries (Pure holding company)

―JAPAN POST BANK Co., Ltd.

JAPAN POST BANK provides comprehensive financial services to a wide range of customers nationwide through its network of post offices, guided by its purpose of “striving for the happiness of customers and employees while contributing to the development of society and local communities.”

Company Name: JAPAN POST BANK Co., Ltd.

Representative: Takayuki Kasama, President & CEO, Representative Executive Officer Member of the Board of Directors

Business Activities: Deposits, Money Transfers, Investment Trusts, etc.

―DeCurret DCP Inc.

DeCurret DCP contributes to building a prosperous society by digitizing the roles of all currencies and values. We aim to solve various social issues by building a platform that supports the issuance and operation of tokenized deposits (digital currency DCJPY). We also serve as the secretariat for the Digital Currency Forum, which was launched in December 2020.

Company Name: DeCurret DCP Inc.

Representative: Satoshi Murabayashi, Representative Director, Chairman and President, CEO

Business Description: Digital currency business, Electronic Payment Services Operators- Directior of the Kanto finance Bureau No. 92

* ) According to research by Shinoken Group, September 2025