Regarding the Commencement of Collaboration on the First-in-Japan Practical Verification of Security Token Payments Using Tokenized Deposits

SBI SECURITIES Co.,Ltd. (President: Masato Takamura, hereinafter “SBI Securities”), Daiwa Securities Co.Ltd. (President and CEO: Akihiko Ogino, hereinafter “Daiwa Securities”), SBI Shinsei Bank, Limited (Representative Director, President: Katsuya Kawashima, hereinafter “SBI Shinsei Bank”), BOOSTRY Co., Ltd. (President and CEO: Kazuma Hirai, hereinafter ‘BOOSTRY’), Osaka Digital Exchange Co., Ltd. (Representative Director & President: Kimio Mikazuki, hereinafter “ODX”), DeCurret DCP Inc.(Representative Director, Chairman and President: Satoshi Murabayashi, hereinafter “DeCurret DCP”) have commenced collaboration on a proof-of-concept (hereinafter “this project”) for DVP2 settlement of security tokens (hereinafter ‘ST’) using tokenized deposits DCJPY (hereinafter “DCJPY”). This aims to realize a new settlement scheme for the development of the secondary market for security tokens. Project participants conducted verification of DVP settlement for ST and DCJPY using test data in August 2025, largely completing the system design and operational workflow for DVP settlement as envisioned for secondary ST trading. Moving forward, they will proceed with verification using actual issuance of ST and DCJPY.

■Background of This Project

Since the issuance of Japan's first digital bond (private placement bond) in 2020, the domestic ST market has accelerated in diversifying product offerings and expanding the range of financial institutions handling them. By the end of November 2025, the total amount of public offerings had grown to ¥270 billion3. However, while ST transfers occur instantly on the blockchain, fund settlements are conducted via bank transfers. This has led the securities industry to identify strengthening settlement risk management and reducing administrative burdens as key challenges. As the ST market expands, resolving these issues becomes increasingly important, with expectations for standardizing and rapidly implementing a DVP settlement method utilizing digital currencies.

This project will demonstrate a new settlement scheme through system integration between BOOSTRY and DeCurret DCP, applied to ST trading transactions between SBI Securities and Daiwa Securities. This aims to demonstrate DVP settlement as one method for settling trades in the secondary ST market, reducing settlement risk and administrative burden, thereby contributing to the further expansion of the ST market.

■Overview of This Project

〈Demonstration Scope〉

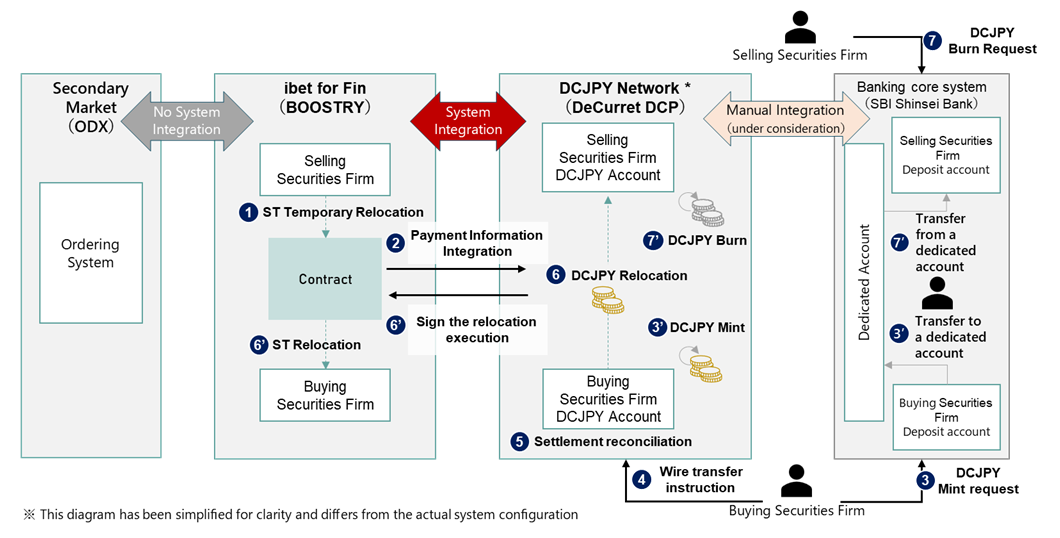

This project's proof-of-concept scope involves DVP settlement using DCJPY during secondary trading of STs. BOOSTRY will lead development and operate/maintain the blockchain “ibet for Fin”4 as the consortium secretariat platform. STs issued and managed on this platform, along with DCJPY issued by SBI Shinsei Bank using the DeCurret DCP platform, will be utilized during the proof-of-concept process. The demonstration scheme and roles of each participant in this project are as follows:

【Figure1: Demonstration Scheme Diagram】

① The selling securities firm temporarily transfers the security token (ST) (preparation before final transfer)

② ST settlement information is synchronized between systems

③ The buying securities firm requests issuance of DCJPY (transfers the issuance amount from the deposit account to the dedicated account)

④ The buyer securities firm issues a transfer (wire) instruction for DCJPY to the seller securities firm

⑤ DeCurret DCP verifies the settlement information

⑥ Simultaneously with the DCJPY transfer, signs the ST transfer execution via system linkage (ST undergoes final transfer)

⑦ The seller securities firm requests the redemption of DCJPY (transfers the issued amount from the dedicated account to the deposit account)

【Figure2: The Role of Participants in the Demonstration】

| Company | Participants' roles |

| Daiwa Securities | Acquisition and trading of ST |

| SBI Securities | ST Trading |

| SBI Shinsei Bank | Issuance and Redemption of DCJPY |

| BOOSTRY | Leadership in ibet for Fin development, provision of ST issuance and management systems |

| DeCurretDCP | Provision of the DCJPY Network, etc. |

| ODX | Participated in this demonstration as an observer |

〈Tokenized Deposit DCJPY〉

Digital currency is a general term for assets possessing monetary characteristics that are recorded, managed, and transferred using distributed ledger technology. This enables programmability in settlement through the functional features of distributed ledger technology, streamlining securities settlement processes such as DVP (Delivery Versus Payment) and settlement operations within securities administrative workflows. This is expected to reduce settlement risks and alleviate administrative burdens. DCJPY, used as a settlement means in this project, is a tokenized deposit provided by the DeCurret DCP platform, representing tokenized bank deposits. Tokenized deposits are considered a strong candidate for ST settlement due to their properties, such as value stability and accounting treatment, which align with those of conventional deposits. In this project, SBI Shinsei Bank will issue and redeem DCJPY using the platform provided by DeCurret DCP.

〈Current progress〉

In August 2025, project stakeholders gathered to conduct verification of ST corporate bond and DCJPY DVP settlement using test data. Specifically, after clarifying the operational flow for securities settlement in ST's secondary market among stakeholders, the project confirmed a simulated DVP settlement scheme. This involved using verification ST corporate bonds issued via the “ibet for Fin” blockchain test environment—developed under BOOSTRY's leadership and operated/maintained by the consortium secretariat—alongside verification DCJPY issued via the DeCurret DCP test environment. The implementation involved participation from all securities settlement stakeholders, including the participating companies for the actual issuance verification—the primary objective of this project—enabling confirmation of the system image and operational workflow related to DVP settlement. Moving forward, we will advance discussions on system integration and operational procedures between both the ibet for Fin and DeCurret DCP platforms, aiming towards proof-of-concept with actual issuance of ST and DCJPY.

■Future Outlook

This project is positioned as the first step toward achieving instant gross settlement for STs in the future. Following this proof-of-concept, we plan to widely disseminate the results to ST market participants. We will then advance discussions among stakeholders toward practical implementation, enabling the new DVP settlement scheme verified in this project to be used between multiple securities firms participating in the ST secondary market “START” operated by ODX and the ST platform. By establishing this settlement scheme as one of the common settlement infrastructures in the secondary market for ST, we will enhance market efficiency, reduce settlement risks, and contribute to the development of a healthier market.

1 Security Token (ST): A digitalized security issued and managed using blockchain technology

2 DVP Settlement: Stands for Delivery Versus Payment. A settlement method where the delivery of securities and the payment of funds are mutually contingent, meaning one cannot occur unless the other is completed

3 Based on https://boostry.co.jp/st-data

4 ibet for Fin: A consortium-based blockchain platform specialized for the issuance and circulation of STs.

【Company Profile】

| Company name | SBI SECURITIES Co.,Ltd. |

| URL | https://www.sbisec.co.jp |

| Location | 1-6-1 Roppongi, Minato-ku, Tokyo |

| Representative | President and CEO Masato Takamura |

| Business description | Financial Instruments Business / Kanto Local Finance Bureau (Financial Instruments Business) No. 44 |

| Company name | Daiwa Securities Co. Ltd. |

| URL | https://www.daiwa.jp/ |

| Location | Grant Tokyo North Tower, 1-9-1 Marunouchi, Chiyoda-ku, Tokyo |

| Representative | President and CEO: Akihiko Ogino |

| Business description | Securities trading, brokerage, agency, or intermediary services for securities trading, underwriting of securities, and other financial instruments trading businesses, as well as related businesses |

| Company name | SBI Shinsei Bank, Limited |

| URL | https://www.sbishinseibank.co.jp/ |

| Location | Nihonbashi Muromachi Nomura Building, 4-3, Nihonbashi-muromachi 2-chome,Chuo-ku,Tokyo |

| Representative | President and CEO Katsuya Kawashima |

| Business description | Financial services and other related activities |

| Company name | BOOSTRY Co., Ltd. |

| URL | https://boostry.co.jp/ |

| Location | PMO Iwamotocho 4F 3-9-2 Iwamotocho, Chiyoda-ku, Tokyo |

| Representative | President and CEO, Kazuma Hirai |

| Business description | Development and provision of a platform for exchanging rights to securities and other assets using blockchain technology (including consulting and IT services) |

| Company name | Osaka Digital Exchange Co.,Ltd. |

| URL | https://www.odx.co.jp/en/ |

| Location | 3-2-18, Nakanoshima, Kita-ku, Osaka City, Osaka |

| Representative | President and CEO Kimio Mikazuki |

| Business description | Proprietary Trading System (PTS) Operation for Stocks and Security Tokens |

| Company name | DeCurret DCP Inc. |

| URL | https://www.decurret-dcp.com/en/ |

| Location | 2-10-2 Fujimi, Chiyoda-ku, Tokyo |

| Representative | Representative Director, Chairman and President, Executive Officer Satoshi Murabayashi |

| Business description | Digital Currency Business/Electronic Payment Agent Kanto Regional Finance Bureau (Electronic Payment Agent) No. 92 |