Various initiatives on “tokenized deposits”

Secretariat of the Digital Currency Forum: In several developed countries various initiatives on “tokenized deposits” are being taken and they are gathering attention globally. Could you explain what tokenized deposits are and what kind of initiatives are being taken?

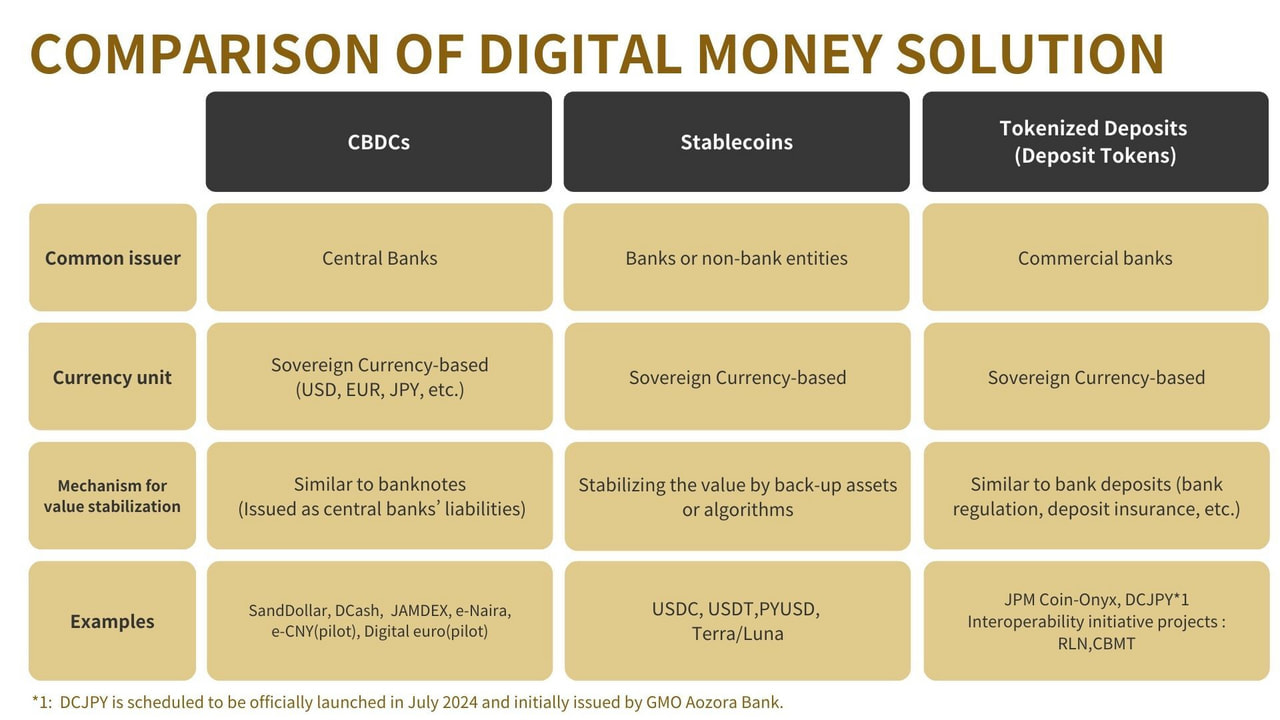

Yamaoka(Chairperson of the Digital Currency Forum): “Tokenized deposits”, which are also called as “deposit tokens”, are bank deposits taking the form of digital tokens with applying blockchain or distributed ledger technology (DLT). As ordinary bank deposit, tokenized deposits are commercial banks’ liabilities.

Various initiatives are now being taken on tokenized deposits. The front-runner in this field was “JPM Coin” introduced by J.P. Morgan Chase in 2019. Then, J.P. Morgan Chase established “Onyx” with the platform of JPM Coin as its “Coin Systems”, and Onyx has been conducting wide-ranging projects including those on tokenized deposits.

The project of “Regulated Liability Network (RLN)”, which has been led by U.S. financial institutions such as Citibank, was initiated in 2022. RLN is conducting joint project with the Federal Reserve Bank of New York.

In Germany, several large banks have joined the project of “Commercial Bank Money Token(CBMT)” since 2021.

In Korea, Governor Rhee of the Bank of Korea made an impressive speech entitled as “Embracing the Future: BOK’s Pilot for Tokenized Deposits” in December 2023 at the “MOEF-BOK-FSC-IMF International Conference on Digital Money”, in which I myself also participated as a panelist. In this speech Governor Rhee explained that the Bank of Korea and commercial banks initiated studies on tokenized deposits.

In Japan, the Digital Currency Forum, which was established in 2020, concluded that it should aim at launching JPY-denominated digital currency, and that those digital currency should initially be issued by banks. Based on these concepts, “DCJPY”, the platform for such digital currency, has been created.

The Digital Currency Forum did not explicitly use the words of “tokenized deposits” or “deposit tokens” to describe DCJPY. Nonetheless, DCJPY can be categorized as tokenized deposits since it is denominated by sovereign currency unit, issued by banks as their liabilities, and equipped with blockchain and DLT.

Characteristics of tokenized deposits

Yamaoka: Tokenized deposits are denominated by sovereign currency units such as USD, EUR and JPY so that they would not cause any inconvenience stemming from exchanges of multiple currencies within the nation. Moreover, their value should be stable as that of deposits since they are banks’ liabilities. The soundness of deposits is safeguarded by bank regulation and supervision, which are harmonized by international organizations such as Basel Committee. In addition, in many countries deposit insurance is applied to a part of deposits. These institutional frameworks work to stabilize the value of deposits and contribute to maintain the “singleness of money”, where central bank money (base money) and commercial bank money (deposits) are always interchangeable one by one. Indeed, the “singleness of money” is the basis for efficient economic transactions and people’s daily lives, and deposits are widely used for various transactions including large-value payments and settlements between firms.

Tokenized deposits will be able to make full use of these existing institutional frameworks , and will be as sound and stable instruments as deposits.

At the same time, tokenized deposits will be able to incorporate blockchain and distributed ledger technology (DLT), and to be used in payments and settlements on 24/7 basis. Moreover, tokenized deposits facilitate “delivery versus payment (DVP)” and “payment versus payment (PVP)” through the function of “smart contract”. This function in tokenized deposits can be used also for various automated transactions such as synchronized payments in parallel with the transfer of goods and services. In order to be equipped with these functions, many of tokenized deposits are planning to use “permissioned” blockchain and DLT.

Secretariat: Why are many of tokenized deposits planning to use “permissioned” blockchain and DLT?

Yamaoka: There are two types in blockchain and DLT. The first type is “permission-less” ones, whose representative case is Bitcoin. The second type is “permissioned” ones, in which only the permissioned entities can verify the transactions.

Both “permission-less” and “permissioned” have pros and cons. The fundamental issue is that creating “trust”, which is indispensable in payment and settlement instruments, inevitably accompanies costs. “Permission-less” blockchain tries to create trust from scratch in a fully de-centralized structure, but it needs substantial costs. For example, Bitcoin consumes substantial electricity and needs several minutes for verifying the transactions. These costs may become obstacles especially in large-value and highly-frequent payment and settlements.

On the other hand, the issuers of tokenized deposits are banks, which have already been under the strict regulation and supervision. By using the “permissioned” blockchain and DLT, tokenized deposits can make use of the existing “trust” of banks, save the costs for establishing trust and facilitate large-value and highly-frequent payment and settlements. Needless to say, “permissioned” means that only the permissioned entities can “verify” the transactions, and anyone can use tokenized deposits as long as they can access to bank accounts.

Secretariat: Why are many initiatives now taken on tokenized deposits?

Yamaoka: In view of rapid digital innovation, many countries and entities are now seriously thinking about the ideal design of payment and settlement infrastructure that can maintain the benefits and advantages of the existing system while utilizing new technologies to enhance efficiency and economic welfare. As a consequence, many of them come to find a similar solution, which is to tokenize bank deposits through digital technology.

Indeed, many reports, research papers and speeches on tokenized deposits raise similar issues and solutions. They stress the importance of supplying credible payment and settlement instruments with stable value and equipped with cutting-edge technologies. Moreover, especially in advanced economies bank accounts are widely used. In addition, bank regulation and deposit insurance function well. Many entities have been considering how these existing assets should be utilized in designing financial infrastructure in the coming future. It is fruitful and meaningful to discuss about the ideal design of financial infrastructure with global peers facing similar challenges.

Difference between tokenized deposits and crypto-assets

Secretariat: What differs tokenized deposits from crypto-assets?

Yamaoka: The first generation crypto-assets such as Bitcoin use their own units such as “bit”, instead of sovereign currency units such as USD, EUR or JPY. Although some crypto-assets have mechanisms to control their supply, their value are very volatile and unstable.

The stability of the value is the primary requirement for payment and settlement instruments. No one wants to receive the instruments whose value might decline tomorrow, and no one wants to use the instruments whose value he or she believes to increase tomorrow. This is the basic reason why crypto- assets are rarely used as payment and settlement instruments and remain to be tools for speculative investment instead.

Some argue that crypto-assets are needed to make efficient transactions of security tokens (STs) and non-fungible tokens (NFTs) because both of them use blockchain and DLT. But since the value of STs and NFTs tends to be volatile, if the value of payment instruments for their transactions is also volatile, their transactions would accompany substantial risks both in asset and payment legs. As a result, their markets tend to become very speculative and their sound developments will be hindered. Also in this regard, instruments with stable value and equipped with blockchain and DLT are needed.

Tokenized deposits are expected to satisfy these requirements, since they are denominated by sovereign currency units and their value is as stable as that of existing bank deposits. Moreover, since tokenized deposits incorporate blockchain and DLT they can be used for the transactions of new digital assets.

Difference between tokenized deposits and stablecoins

Swcretariat: Various “stablecoins” are also issued in order to stabilized the value of crypto-assets. What differs tokenized assets from those stablecoins?

Yamaoka: There are two categories of stablecoins. The stablecoins in the first category are those embedding algorithms that automatically reduce their supply when their value declines. However, in the real world the value of those stablecoins is very volatile. The mechanism of stabilizing the value of currencies is very complicated, and at this juncture it is difficult to replace them with a specific algorithm.

The stablecoins in the second category are those being backed up by safe and liquid assets such as treasury bills. But the issuers of stablecoins could have incentives to reduce the quantity and quality of back-up assets in order to obtain more seigniorage. In fact, many “stablecoins” without fully backed up by high-quality liquid assets are issued, and their value often fluctuates. The typical incident in such cases was the collapse of stablecoins “Terra” and “Luna” in 2022, and the authorities in many advanced economies are now strengthening their monitoring of stablecoins. On the other hand, since tokenized deposits are liabilities of banks, they can stabilize their own value without having back-up assets.

In Japan, the Payment Services Act revised in 2023 legally defines only the instruments denominated by sovereign currency units and backed up fully by safe assets as “electronic payment instruments”. In other words, the crypto-assets without having sufficient back-up assets continue to be regulated as crypto-assets even if they argue that they have some back up assets or that they have mechanisms to stabilize their value.

The Financial Services Agency in Japan is fully aware of the problems regarding stablecoins in overseas economies, and has taken actions to avoid them.

Credit creation mechanism of modern monetary system

Secretariat: Then, if stablecoins have back-up assets with sufficient quantity and quality, will they become similar to tokenized deposits?

Yamaoka: Indeed, from the viewpoint of users tokenized deposits and stablecoins with sufficient back-up assets are similar in a sense that their value is stable. At the same time, we need to examine their implications on overall monetary systems and the economy. Regarding this issue, many article and reports were recently published, such as “The Future of Payments is Not Stablecoins” written by the economists of the Federal Reserve Bank of New York in 2022 .

The Modern monetary system has two-tiered structure of a central bank and commercial banks. The central bank provides reserves as base money to commercial banks, and commercial banks provide deposits as commercial bank money to firms and individuals. Due to partial reserve system and credit creation by commercial banks, banking system can provide substantially larger amount of commercial bank money than base money to the economy. Indeed, in the statistics of monetary aggregates M1 and M2 are much larger than M0.

Through this two-tiered structure the modern monetary system enables both financial intermediations led by market mechanisms and sufficient supply of commercial bank money as payment and settlement instruments enough to facilitate economic transactions. This system is very well articulated in terms of satisfying both efficient resource allocation and abundant supply of money.

As long as stablecoins are 100 percent backed up by perfectly safe and liquid assets such as treasury bills and central bank reserves, their value can be stable. On the other hand, the supply of these stablecoins is limited by the quantities of safe and liquid assets, since there is no credit creation. If stablecoins try to keep their value stable, they have to tie up substantial amount of safe and liquid assets, which are also needed to satisfy regulatory requirement of liquidity buffers and collateral. In sum, stablecoins could face the shortage of their supply or lock up safe and liquid assets for payments and settlements. In view of these inherent constraints, “The Future of Payments is Not Stablecoins” concluded that “stablecoins are unlikely to be the future of payments”, and suggest that “tokenized deposits might be a fruitful avenue to pursue”.

This issue is similar to the “narrow banking” debate raised in the late 20th century. Some scholars argued that the issuers of commercial bank money should be limited to “narrow banks”, whose liabilities were 100 percent backed up by safe and liquid assets. Those narrow banks did not become a new monetary model in the real world, however, mainly because they would lack the capacity of supplying sufficient money and credits to the economy.