Benefits and advantages of tokenized deposits

Secretariat: Then, what are possible benefits and advantages of tokenized deposits?

Yamaoka: The Digital Currency Forum has discussed on the ideal design of payment and settlement infrastructure in the coming future, and DCJPY platform was built in line with the Forum’s proposal. Possible benefits and advantages of tokenized deposits are almost same as those of DCJPY.

First, tokenized deposits are able to satisfy both financial intermediations led by market mechanism and supply of sufficient money to the economy through credit creation. In other words, tokenized deposits can maintain the functions of bank deposits and the benefits of the existing monetary system.

Second, tokenized deposits will be able to incorporate blockchain and DLT, and to utilize the function of “smart contract”. Accordingly, tokenized deposits can be “programmable”. Through this function tokenized deposits will be able to facilitate automation of back-office operations, DVP and PVP.

Third, wider use of tokenized deposits will not cause outflow of funds from banking sector since they are banks’ liabilities, and they will not accelerate liquidity crises in market stresses. Accordingly, it will not be necessary to impose quantitative limit on their usage to avoid outflow of funds from the banking sector.

Any quantitative limit on payment and settlement instruments inherently impairs their utility. In this regard, since bank deposits are widely used for large-scale payments between firms, tokenized deposits will also be used for large-value payments in, such as, transactions between firms, trade transactions and fund-raising through security tokens.

Secretariat: How should we think about the relationship between tokenized deposits and existing financial regulation?

Yamaoka: Another benefit of tokenized deposits is that they can make use of existing financial regulation.

In most countries banks are under stricter regulation and supervision than other industries, and a part of deposits are covered by deposit insurance. Through these institutional frameworks the soundness of bank deposits is safeguarded, and the “singleness of money”, where bank deposits, cash and central bank reserves are always exchangeable one by one, is maintained.

Indeed, the stability of the value is the most important prerequisite for payment and settlement instruments. There can be a variety of arrangements to keep their value stable. For example, they could be backed up by safe and liquid assets, or issued directly by a central bank. But tying up safe and liquid assets for payment and settlements may accompany hidden costs. On the other hand, tokenized deposits can safeguard their stability through using existing institutional frameworks, without additional costs.

Tokenized deposits and wholesale CBDCs

Secretariat: You also mentioned that direct issuance of payment instruments by a central bank could be another option to safeguard their stability. In this regards, various initiatives on central bank digital currencies (CBDCs) have been taken in recent years. How should we think about the relationship between tokenized deposits and CBDCs?

Yamaoka: There are two types of CBDCs. The CBDCs in the first type are “general-purpose CBDCs” or “retail CBDCs”, which are expected to be used in a variety of transactions by ordinary people instead of cash. The second type of CBDCs are “wholesale CBDCs”, which are issued mainly to banks for large-value settlements. Among them, possible linkage and collaboration with wholesale CBDCs to enhance the efficiency of economic activities could be another potential benefit of tokenized deposits.

Since central banks provides central bank accounts mainly to banks and operate RTGS (Real-Time Gross Settlement) systems such as Fedwire and TARGET for large-value settlements, the issuance of wholesale CBDCs is unlikely to cause problems such as erosion of bank deposits.

In large-value settlements there are economic needs to use risk-free central bank liabilities. In Japan interbank settlements of 100 million JPY or above are directly settled through BOJ-Net, which is the RTGS system operated by the Bank of Japan. It is natural that many central banks are interested in the idea of wholesale CBDCs, which could innovate central bank settlement systems through new technologies.

Indeed, many initiatives have been taken on wholesale CBDCs recently. In 2016 when I was working in the Bank of Japan as the Head of Payment and Settlement Systems Department, the European Central Bank and the Bank of Japan started “Project Stella” as joint studies on wholesale CBDCs.

Secretariat: What kind of benefits will be brought about from cooperation and collaboration between wholesale CBDCs and tokenized deposits?

Yamaoka: The cooperation and collaboration between wholesale CBDCs and tokenized deposits fully reflect the current two-tiered system of a central bank and commercial banks, so they will also maintain its benefits and advantages.

In many countries, central banks operate RTGS systems and commercial banks supply deposits to firms and individuals. Wholesale CBDCs can be regarded as applying new technologies such as blockchain and DLT to RTGS systems, and tokenized deposits adopt these technologies to deposits.

Accordingly, the combination of wholesale CBDCs and tokenized deposits will update the modern monetary system through cutting-edge technologies with maintaining its two-tiered structure and its advantages.

Secretariat: Are there initiatives on possible cooperation between tokenized deposits and wholesale CBDCs?

Yamaoka: Yes. For example, Regulated Liability Network did joint study on the settlement of digital assets with the Federal Reserve Bank of New York in 2023. Also in 2023, Bank of Korea announced to start the project on the collaboration of wholesale CBDCs and tokenized deposits, and the Monetary Authority of Singapore announced to conduct the project on digital SGD, in which large banks in Singapore and JP Morgan Chase participate in the collaboration of wholesale CBDCs and tokenized deposits.

In the field of cross-border payment and settlements, there have been initiatives to connect several platforms of wholesale CBDCs and commercial banks in order to enhance efficiency of overseas remittances. For example, the Bank for International Settlements (BIS) and central banks of Australia, Singapore, Malaysia and South Africa embarked on joint project entitled as “Project Dunbar” . In April 2024 the BIS, central banks in France, Japan, Korea, Mexico, Switzerland, United Kingdom and the Federal Reserve Bank of New York announce to initiate joint project entitled as “Project Agor” .

Secretariat: Will tokenized deposits and wholesale CBDCs be able to create positive chemistry?

Yamaoka: I think so. From the viewpoint of central banks, since their RTGS systems are mainly for large value settlements between banks, it is necessary to cooperate with commercial banks in order to enhance welfare of individuals and firms. Since wholesale CBDCs can be regarded as innovated RTGS systems, it will be necessary for wholesale CBDCs to make full use of private initiatives in order to contribute to overall economy.

From technological viewpoints, practical benefits of wholesale CBDCs will be to facilitate DVP, PVP and transactions of new digital assets through their programmability. These benefits could be maximized if bank deposits, which would be linked to wholesale CBDCs, are also programmable.

Secretariat: Will wholesale CBDCs be beneficial to tokenized deposits?

Yamaoka: Wholesale CBDCs will not be a necessary condition for tokenized deposits, since interbank settlements are being processed smoothly through existing infrastructures such as private-based interbank netting system and central bank RTGS systems. Accordingly, interbank balances stemming from exchanges of tokenized deposits will be able to be settled through incumbent systems.

Having said that, I think that wholesale CBDCs could be beneficial to tokenized deposits. In order to maximize the benefits of tokenized deposits, it is desirable to automatically synchronize the platforms of tokenized deposits and wholesale CBDCs to enhance the efficiency of transactions. The Digital Currency Forum will closely monitor the developments of international discussions on wholesale CBDCs.

Tokenized deposits and financial infrastructure in future

Secretariat: Will on-going discussions on tokenized deposits bear fruits in the coming future?

Yamaoka: I believe so. The ultimate goals of financial infrastructure are to enhance efficiency of transactions, to increase people’s welfare and to make the economy grow. “Digitization” and “Tokenization” are not goals but tools to achieve them. The Digital Currency Forum has discussed comprehensively about the ideal design of financial infrastructures in the coming future from scratch. It is really encouraging for the Forum to see that similar discussions and studies are taking place globally.

Secretariat: Will these discussions and studies lead to sharing of common understanding and visible outcomes?

Yamaoka: Yes. It seems that these discussions and studies are approaching to similar solutions.

For example, regarding the reaction to “Libra” project, which was led by Facebook(Meta) and announced in 2019, the first global reaction was strong cautiousness against the idea of “global stablecoin backed up by multiple safe currencies”. Some even argued that retail CBDCs should be issued to compete with Libra. However, from theoretical viewpoint Libra tried to use the trust to existing safe currencies in order to establish its own trust. Accordingly, the credibility of Libra cannot exceed that of back-up currencies. So, for the central banks that issues credible sovereign currencies that could have been Libra’s back-up assets, there is no urgent necessity to issue retail CBDCs just for competing with Libra. Moreover, also for the currencies with low credibility, their digitization will not raise their credibility at all. The only way to raise their credibility is to conduct fiscal and monetary policies prudently, and the issuance of retail CBDCs should not be an effective counter-measure.

The initial purpose of Libra project was to enhance efficiency of overseas remittances. Indeed, many people complained about their inconvenience and asked for improving their efficiency. The policy authorities should listen to these opinions and consider how to make overseas remittances more convenient. Now global discussions are seeking for effective solutions to this issue, and the cooperation of tokenized deposits and wholesale CBDCs is regarded as one of such initiatives.

Secretariat: It is important to consider what kind of value monetary systems can create through new technologies, isn’t it?

Yamaoka: Yes, it is. In Japan some people are very sensitive to the developments of China. Hearing the news that China started wide-scale experiments of retail CBDC entitled as “e-CNY”, they often argue that Japan should issue retail CBDC to compete with CNY. Since China is now the biggest importer of various commodities, it is sure that China is trying to increase the presence of CNY in international trades. But even if Chinese people use e-CNY instead of Alipay or WeChat Pay in domestic transactions, there is little impact on overall demand for CNY since all of these payment instruments are already denominated in CNY, regardless of whether they are issued by private firms or the central bank. The internationalization of CNY ultimately depends on whether trade counterparts prefer USD, CNY or other currencies. For internationalization of CNY, closer attention should be paid to China’s stance on capital control and the developments of Cross-border Interbank Payment System (CIPS) rather than retail CBDC.

In a similar vein, if we want to increase international presence of JPY, we need to consider how we should enhance the utility pf JPY in trades and cross-border transactions, before thinking about issuing retail CBDCs to compete with CNY. In international trades, not only goods and services but also many documents including letters of credit and bills of lading are moved and transferred, and it will be beneficial if we have “programmable” instruments that automatically synchronize payments with the movement of those goods, services and documents.

Secretariat: Will tokenized deposits contribute to efficiency in trade transactions and overseas remittances?

Yamaoka: I believe so. Many studies and reports on tokenized deposits pointed out the efficiency gains in trade transactions and overseas remittances as their possible benefits. As one of possible uses cases of DCJPY platform, the Digital Currency Forum also raised trade transactions and has conducted studied and initiatives such as PoC (proof of concepts) in this field.

Secretariat: What kinds of lessons and findings have the discussions on payment infrastructure in future brought about?

Yamaoka: Through the discussions on ideal financial infrastructure in future, many entities have recognized and more deeply understood that the current monetary system, which are adopted by most of countries worldwide, are well designed and articulated, reflecting the wisdom of humans accumulated in the history. In this two-tiered monetary system, based on the partial reserve system commercial banks provide deposits, which works as the core of both financial intermediation and payment infrastructure utilizing market mechanisms. To fully utilize and to further enhance these functions of deposits are major considerations behind various initiatives on tokenized deposits.

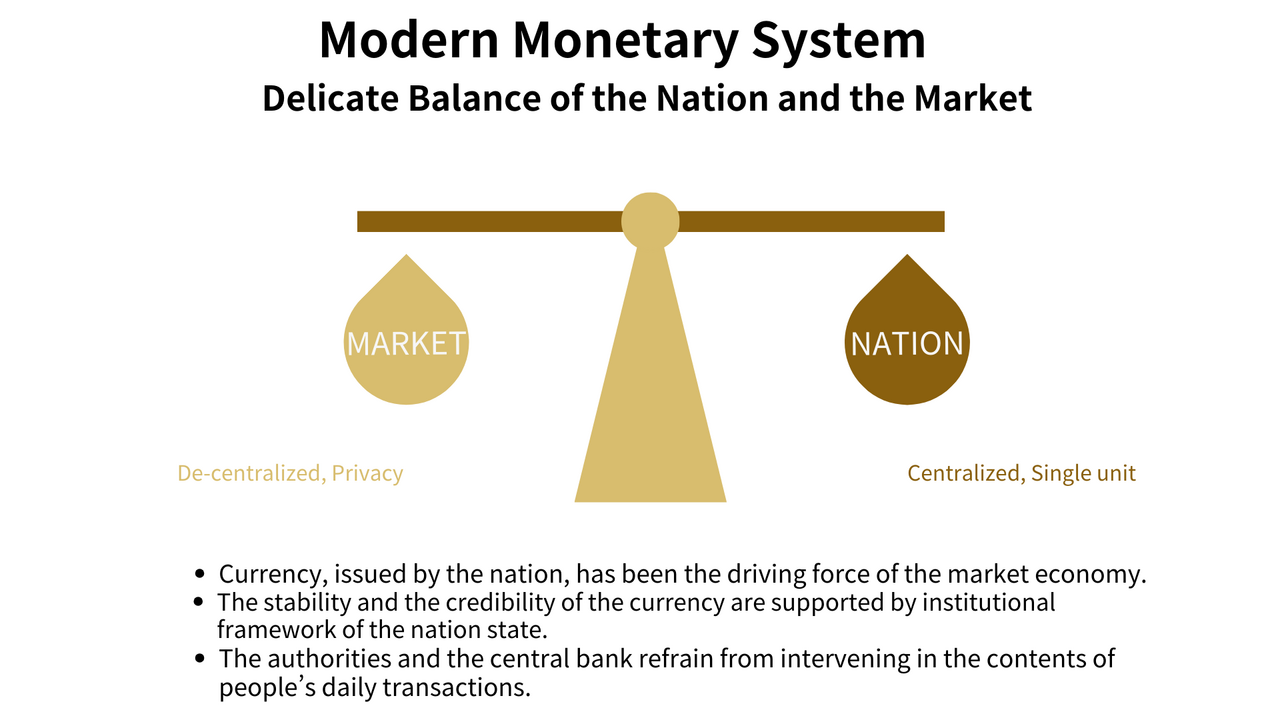

The current monetary system is based on the sophisticated balance between the nation and the market and between centralized and de-centralized structures. In this system, a single currency unit such as USD or JPY is used within a single country, and the trust and credibility of each currency is safeguarded by legal, tax and institutional systems as well as financial regulations. Moreover, in cases of common currencies such as EUR, harmonization on fiscal discipline and other international policy arrangements also work to maintain their trust and credibility.

Crypto-assets, such as Bitcoin, are decentralization-oriented and may change this balance, leading to high costs for creating trust. Indeed, crypto-assets are rarely used as payment instruments and remain as speculative investment tools.

On the other hand, central banks told that if they issue retail CBDCs in future they should be issued indirectly through commercial banks and other intermediaries. In other words, central banks do not adopt the idea of providing retail CBDCs directly to every citizen. Direct issuance of retail CBDCs may also change the balance toward more centralization-oriented, and consequently could affect market-based innovation and data utilization.

In this regard, tokenized deposits are expected to maintain the sophisticated balance on centralized and de-centralized structures. Accordingly, it is expected that tokenized deposits will be able to succeed the benefits and advantages of the current monetary system.

Secretariat: Can we expect positive feedbacks between global discussions on tokenized deposits and the initiatives of Digital Currency Forum on DCJPY platform?

Yamaoka: Absolutely. The Digital Currency Forum has discussed about ideal design of monetary infrastructure in the coming future. Under the innovation in information technology, similar discussions are taking place globally and many of them are now sharing common understandings and similar solutions. These developments are very encouraging for us and we have already seen many positive feedbacks among them.

Especially in Japan where bank accounts are widely used, it is highly needed to make use of them. According to the survey made by Japanese Bankers Association in December 2021, 99.6 percent of the respondents already use the accounts of depository institutions . In order to innovate Japan’s monetary infrastructure, it will be the most effective way to update bank deposits, which are widely used and contribute to people’s daily lives, through applying new technologies.

Secretariat: Will it be possible for DCJPY platform to cooperate with platforms of tokenized deposits in overseas economies?

Yamaoka: Yes, it will. In correspondent banking services, many banks and bank accounts have already been cooperating with each other to offer various services to each customer. If bank deposits are tokenized through new digital technology and their transfers are synchronized through the linkages of various platforms, more advanced and sophisticated services will be available in future.

Secretariat: Then, it is becoming more and more important for each initiative on tokenized deposits to collaborate and cooperate with others, isn’t it?

Yamaoka: Yes. Many studies and reports on tokenized deposits also raised many promising areas where collaboration and cooperation between platforms could be important. For example, they raised trade transactions, overseas remittances, green financing and the transactions of new digital assets including security tokens and non-fungible tokens.

Indeed, the Digital Currency Forum is obtaining a lot of information, knowledge and insights from grobal discussions. The Forum will continue monitoring carefully the developments of various initiatives overseas. Also, the Forum will share our initiatives and knowledge, and communicate with global peers.